I am a member of the Collective Bias Social Fabric® Community. Collective Bias has provided me with compensation for my time and effort to evaluate this website. Participation in this program is voluntary. As always, all opinions are 100% my own. #CollectiveBias

Tweetvar fbShare = {size: ‘small’,}

(function() {

var po = document.createElement(‘script’); po.type = ‘text/javascript’; po.async = true;

po.src = ‘https://apis.google.com/js/plusone.js’;

var s = document.getElementsByTagName(‘script’)[0]; s.parentNode.insertBefore(po, s);

})();

There’s a love/hate relationship that goes on about your children growing up. You love that you can give your kids more freedom and independence, but you hate that because of that you worry and have sudden added expenses. Any of you with teenagers on your auto insurance know exactly what I mean.

We’ve dodged the driver’s license bullet with our daughter for a couple of years now. First because she really had no where to drive and then again because of our move to Texas last year. We’ve been okay with being her chauffeur up until now, but she’ll be a university student in fall living away from home and we know the inevitable has arrived. She’s going to have to learn to drive. As she has no money for her own car, that means we’re going to have to add her to our insurance policy.

I’ve heard horror stories from other parents about how their car insurance rates sky rocketed when they added their teens to their policies. Truth be told, I’ve never actually priced it out.

We’re quite happy with our current insurance but we are also aware that they aren’t the most affordable option. So I thought it would be wise to compare rates on AutoInsurance.com to give us an idea of what kind of dollar figure we might be looking at by adding our teenager to our policy. Seeing as the site is not affiliated with any particular insurance company, the rates quoted are not biased and you can compare your options against your current policy.

It’s easy to get started. First you enter in your zip code.

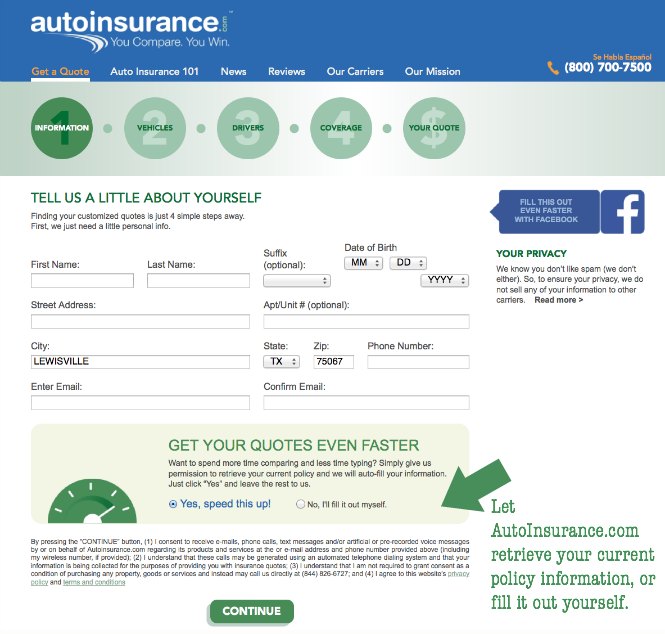

Then you fill out your personal information. You have the option of letting AutoInsurance.com retrieve your current car insurance policy for comparison purposes or you can fill the information in yourself.

I chose to do it myself and it was simple to complete. By pressing the “continue” button when you’re done this part, you are opting in to receiving communications from AutoInsurance.com, but you aren’t obligated to buy anything and the service is free to get a quote.

Once that’s done you go on to selecting the kind of coverage you’d like. I matched the amounts to what we currently have.

Then I just need to press “Get Your Quote” to find out how much money it would cost me to allow my teen to drive my car  .

.

So compared to what we pay now with the same coverage adding our teen to the policy could cost between $238 to over $1500 more for six months, depending on which company we’d choose. AutoInsurance.com currently has six providers that offer quotes: Progressive, Travelers, Esurance, 21st Century, The General and Safeco. You can also see what your quote would cost with other coverage amounts and deductibles.

At this point if you’re happy with the price of the quote you’ve been offered you can buy it right then and there! If you prefer to talk to someone about the coverage before purchasing they do offer online chats or you can call them. If you’re not quite ready to buy, that’s okay, you’ll receive an e-mail with your quotes, and you can check back with it later.

I’m glad I checked into this on AutoInsurance.com because I was able to get a ballpark figure, so when Amber does start driving I know what to expect when we talk to our agent without having sticker shock.

It also makes us more savvy consumers if our company can’t give us a comparable rate to the quote given on AutoInsurance.com. Now we know of other options and can shop around for a policy that might fit better into our budget.

If you live in Texas, Arkansas, Oklahoma, Missouri, Louisiana, Tennessee or Mississippi you can check out AutoInsurance.com and see if you could #Compare2Win and save money on your vehicle insurance. If you want to connect with or learn more about AutoInsurance.com you can also find them on Twitter and Facebook.

Tammy Litke is a Dallas blogger, blogging since 2008. She loves to watch movies, play video games, spend time in the kitchen, and travel. Between recipes and reviews you’ll find many helpful and some just plain funny posts on her blog. Welcome, pull up a chair and stay for a while!

Tammy Litke is a Dallas blogger, blogging since 2008. She loves to watch movies, play video games, spend time in the kitchen, and travel. Between recipes and reviews you’ll find many helpful and some just plain funny posts on her blog. Welcome, pull up a chair and stay for a while!

I used to work for a car insurance, and young drivers can be pricey, so I totally suggest shopping around! Looks like a great way to do that!

It's time for us to make sure we have the best price for all our insurances. I'll check it out, thanks!

We just asked our insurance company about adding our daughter but they said there's no additional fees until she has her driver's license, as a beginning driver she is ok for now. Whew. Glad for that as it gives us 7 or 8 months without added costs.

I'd like to get a new quote for our cars.

I'm not ready for this! They grow up too fast. But it sounds like a great way to get financially prepared.

This looks like an easy way to shop for new car insurance. It is about time I see what else is out there.

Oh AutoInsurance.com please come to Nevada! I have been wanting to compare rates from other carriers to see if we are truly getting the best deal and have no time (or patience) to call a million agents.

How easy is it to shop for car insurance these days! I am with you on the love/hate of your kids growing up… eh.

I remember the sticker shock that happened when the kids started driving. The only way we could swing it was to do PLPD only on the vehicle. That worked out perfectly.

Auto insurance rates just keep going up every year. It is best to shop around each renewal period.

Oh my goodness…the picture in the Cozy Coupe is precious! #client